thinktum’s liz suite

thinktum’s liz suite enables the insurance industry to automate the insurance application and acceptance processes to provide more targeted products and maximize honest disclosures while adding much-needed personalization to the sequence. This means more policies issued, happier customers, and a healthier bottom line.

The insurance industry has been stuck in a sort of technological amber for years now. Many companies have taken their offerings online lately. Some use software solutions such as Slack, MS Teams, Google Suite, or others to encourage collegiality and efficiencies; but after that, underwriters are still relegated to their desks for hours at a time reading through applications and supporting documentation to approve or deny coverage based on the data provided in the application process. It’s slow, boring, and routine work that has to be done to keep the company afloat.

With artificial intelligence (AI) and machine learning (ML) becoming less sci-fi and more business reality, things are really starting to change in the market, and thinktum is determined to meet this challenge head-on. thinktum believes in technology that serves humanity for the better. Augmentation, which we define as the marriage of human cognition and artificial intelligence, is really more human-steered AI than a full collaboration. Artificial intelligence is just another tool, like a bicycle, that still needs a human to ride it to make it useful. While many misconstrue augmentation as AI “augmenting a human being’s added-value”, the opposite is actually true – the human mind is the it-factor that enables AI, which in turn, empowers human beings.

Find out more about augmentation in Augmentation, the alliance of an era.

Meet liz, our modular glass-box solutions suite

Why liz? Elizebeth Friedman was an American cryptanalyst who spent her career during World Wars I and II solving, breaking, and out-thinking enemy codes. She was the one they called in when everyone else was stumped. She was a “secret weapon for hire”. Inevitably she broke many codes and helped allies win both wars. Her work was later declassified and written about in a book. Our liz was named after her: “The Woman Who Smashed Code”.

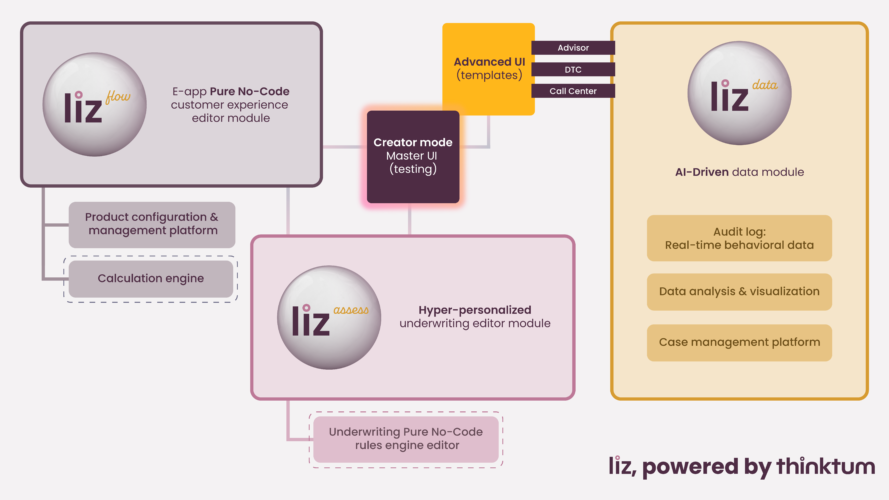

liz is a modular suite comprised of three stand-alone solutions that work great separately, and even better together. They each have a different role to play in providing a robust solution.

Let’s start with liz flow, our Pure no-code platform module.

liz flow, Pure no-code platform module

liz flow is the perfect solution for advisor, direct-to-consumer, or hybrid businesses to optimize, amplify, and elevate their distribution models. liz flow is a modular, pure no-code e-application and a product configuration and management platform. No-code solutions are revolutionizing the industry because complicated solutions just don’t work anymore. They’re hard to deploy, require tech teams to be ready, and significant user training to get started. Nobody has time for any of that now. Deploy liz flow for back-office systems, e-application journeys, as well as new business processing, policy issue, or multiple e-signature options. We deliver liz flow as Software as a Service, or SaaS. But the best part is that pure no-code means development resources are never required.

liz assess, hyper-personalized underwriting rules engine module

liz assess is thinktum’s hyper-personalized underwriting rules engine. This is where the rubber hits the road, so to speak. liz assess applies behavioral data to maximize honest disclosure. The machine learning algorithms continuously improve the assessment process for the user. liz assess delivers a far better user experience and has the most precise no-medical assessment (actual mortality) known.

Its automated, personalized, and intuitive flow optimizes both the customer journey and advisor experience. By using behavioral analysis to maximize honest disclosure, liz assess avoids human errors and minimizes anti-selection. The tool was designed to support advisors, direct-to-consumer (DTC), and hybrid distribution models. A no-code workbench and pre-assessment modules are also available.

Our Pure no-code technology empowers underwriters in the following ways:

- Fast and easy integration and deployment

- Frequent and instant adjustments and updates

- Greater risk control and management

- Glass-box (transparent) underwriting decision flow

- Real-time application reviews for completions and tries

- Executive underwriting summary with links to critical data points

liz assess is by far our most popular module. But what does Pure no-code mean in this context? Pure no-code refers to the fact that our modeling solutions do not require a technology resources commitment. Anyone can adjust, experiment, and update the system. We provide an intuitive graphic interface that is responsive, easy to use, and dare we say, elegant? Think of it as the WordPress of AI. You don’t need any programming skills to use our tool, and the same is true for all modules of our liz suite.

Deep dive into liz assess with Augmentation and liz assess – a powerful marriage of form and function.

liz data, AI-driven data processing and analytics module

liz data is thinktum’s data processing and analytics module leveraging AI. It provides real-time analytics in the form of monitoring dashboards, logs, timestamps, and more. liz data delivers data visualization and behavioral analysis tools that include business, risk, and robust data analyses, providing instant alerts and recommendations, as well as delivering fraud detection, misrepresentation, and reducing anti-selection.

Here is how it works: liz data pulls that same behavioral analytics data from end-users such as agents and applicants. It provides risk and segment data analysis and predictive analytics. Last, liz data monitors the end-user’s behavior, then a decision-recommendation is provided. That means artificial intelligence helps leaders to monitor users’ behaviors in real-time to optimize processes and minimize or eliminate misrepresentations and fraud.

We told you liz was smart!

liz data optimizes data analysis using AI, demographic data, risk data, as well as user journey data. We also offer in-force data cause and effect analysis on claims and policyholder behavior. Our upgraded reporting capabilities optimize the customer journey and develop predictive analysis with upcoming supervised and unsupervised machine learning data analysis.

liz is the name of the entire software suite. It is our most powerful offering since you get every available module, all-together. Using the liz suite means you will be able to create pre-assessments, achieve optimal data efficiency, and faster implementation. thinktum also provides a nice cost-saving benefit when the complete suite is bundled together. Each module is terrific on its own, but when you use all three, your perks skyrocket.

thinktum and liz

With thinktum and liz, underwriters are more engaged with their work, insurers are better able to offer more specialized plans to a greater number of prospective clients, revenue increases, and the company can avoid misrepresentation and anti-selection better than ever before.

thinktum has solutions to solve a number of complicated issues that insurers, reinsurers, providers, and carriers face every day. We know your issues because we have the relevant experience and understand only too well the kinds of stressors currently facing the industry.

If you’d like to know more about what we do, just wave! We’ll be happy to discuss. If you like what you’ve been reading, are curious about pure no-code, and think an AI-driven solution might be the right fit for your company, reach out to us. We’ll be happy to answer your questions, provide information, and listen. Click the “Reach Out” button in our footer or follow us on all the social media channels displayed there too.

In the meantime, check out our animated depiction of liz’ operational flow:

Still curious? Set up some time with us for a chat!