Of Risk Appetite and Underwriting Philosophy

Risk is the foundation upon which the insurance industry was built. No two firms will have an identical risk appetite or underwriting philosophy. Understanding how risk can be better managed and mitigated can mean all the difference to both applicants and insurers, resulting in a more enjoyable application process for everyone and a healthier bottom line.

A risky business, defined.

Insurance professionals understand risk, they deal with it every second of every workday. At thinktum, we define risk as the possibility of something bad or untoward happening to a person, place, or thing.

Risk appetite is how much and what type of risk insurers or reinsurers are willing to take on; and an underwriting philosophy is which tools and actions ensure the risk appetite is respected. Each work independently as well as together in order to meet the organization’s operational goals.

As you’re probably well aware, every organization has a pretty specific risk appetite that works for them. Some firms take an aggressive stance with risk, while others try to balance higher risk by requiring more evidence in the form of medical details, manual underwriting, or charging a higher premium for a smaller policy. Risk also means different things to underwriters and the companies they work for. The business needs conversions, but underwriters can best understand and appreciate the nuanced differences between good risk and bad. Keep exploring ways to leverage innovation with How insurance carriers are modernizing their technology to meet KPI goals.

It all goes back to an underwriting philosophy that works for everyone. Understanding just how much risk is too much, falls within that philosophy. Specific underwriting actions can manage that risk better. Let’s look at an example to sharpen our point. Steve is a 50-year-old diabetic looking for life insurance through a quick and easy process. He applies for a $100,000 term policy with three different insurers.

- Organization A will decline all policies for anyone with diabetes.

- Organization B will insure diabetics providing certain health parameters are within a specific scope – A1C is below a specified threshold – or they may only insure diabetics on prescribed oral medication.

- Organization C will provide Steve with a policy but the policy amount is lower and the premium higher to account for that risk.

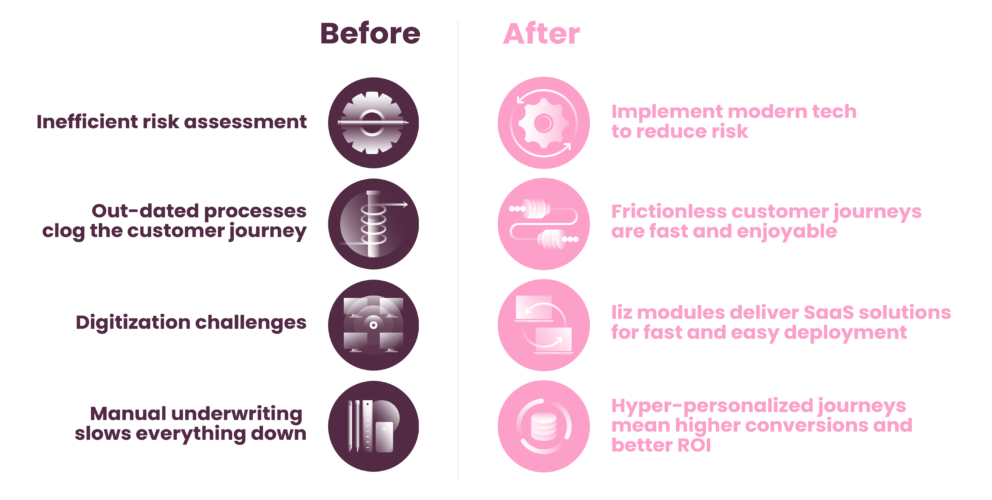

Traditionally, the idea of risk was typically defined by the organization and underwriters had to work within those guidelines as well as the firm’s underwriting guide. But that was only part of it, the rest was seemingly endless rounds of verification, even if it slowed the entire process down to a crawl.

We recognize that it can be difficult to reconcile one’s risk appetite and underwriting philosophy while still putting a significant amount of business through. At thinktum, we believe it takes business expertise and the will to think outside of the box – along with state-of-the-art technology – to revolutionize the industry.

Meet liz, she’s here to help.

thinktum’s Pure no-code modular liz suite provides an elegant solution that can be deployed in weeks, rather than months or years. Pure no-code means technology resources just aren’t required to deploy or maintain the software which sits on top of your current technology infrastructure. liz allows business users the ability to write new questions, add new flows, test, tinker, and edit as you or the business requires.

We designed our solutions to increase organizational capacity and the quality of business while reducing costs. Here’s how:

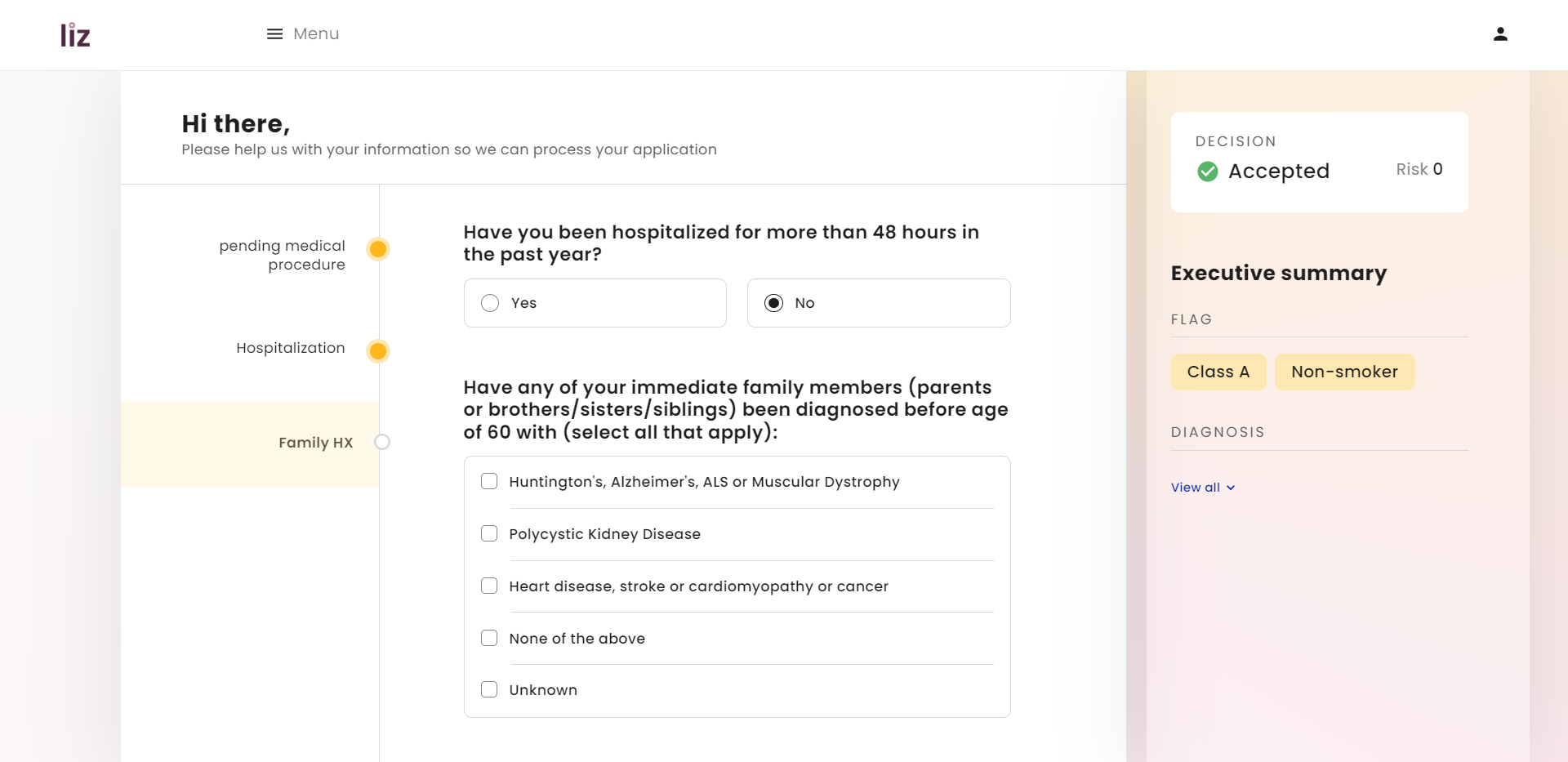

The liz flow module is our editable canvas. It allows the ability to create, edit, delete, and test flows whenever it’s required, warranted, or even preferred. liz flow allows both product and application configurations and deployments. It is equipped with a built-in calculation engine, or connects to another via an API. liz flow provides e-signature and e-delivery functionalities.

liz assess is our robust underwriting rules engine. It’s really where the rubber meets the road, so to speak. liz assess maximizes honest disclosures, collects customer journey data, and triggers hyper-personalized as well as dynamic questions to ensure the fastest & most frictionless application journey.

liz data is thinktum’s data processing and analytics module. It provides real-time analytics in the form of monitoring dashboards, logs, timestamps, and more. This module leverages data visualization and behavioral analysis tools that perform business, risk, and behavioral data analyses, provide instant alerts & product recommendations, detects fraud-associated patterns, and reduces misrepresentation as well as anti-selection. An audit log is included as well as an application summary for all customer journeys.

Our liz suite empowers underwriters by allowing them to:

- Write, edit, and test questions on the fly according to their organization’s risk appetite & underwriting manual. If the risk appetite changes, they can quickly adjust the flow to accommodate it.

- Manage risk better due to hyper-personalization. Compared to existing Accelerated and Simplified Issue static question structures, liz manages any degree of risk better. It uses dynamic questioning, therefore enabling more honest and in-depth disclosure. You can better determine what information must be included in order for your organization to be comfortable issuing the policy according to your underwriting philosophy.

- With simplified language, misrepresentation caused by vague or incorrect answers is minimized.

Find out more about liz in thinktum’s liz suite.

The right customer journey changes everything

With a liz-enabled customer journey, end-users (applicants and advisors alike) get more than the sum of its parts.

Applicants

- A user-friendly frictionless experience.

- A faster and more accurate assessment.

- The ability to conveniently apply online at any time, from any device type.

Advisors

- Decrease in the number of touchpoints between advisors and applicants to complete the entire process of having a policy approved & issued.

- Reduction in the amount of time it takes, on average, from starting the application to its final approval and policy issue.

- Increase in the amount of completion of processes without the need for any further requirements (that’s the friction on their end).

With a liz-enabled customer journey, underwriters get:

- The ability to work within the risk appetite in order to follow up with an application that requires additional information, evidence, or documentation. Underwriters gather information in an environment that typically involves a great deal of uncertainty. Our system allows them to create their own ways to have these questions answered – therefore reducing that uncertainty – which leads to placing more business via straight-through processing.

- The consistent ability to review & optimize the process, identify gaps, and correct them instantly.

- The capacity to evolve and improve an underwriting philosophy to find new and better ways to support the existing risk appetite. At the same time, they’ll continue improving the customer journey for end-users.

All of this, without sacrificing accuracy, risk appetite, or underwriting philosophy. Bonus point: insurers would receive structured data allowing for greater analysis and even further optimization of the customer journey.

How? Simple: this process is designed to eliminate friction and additional requirements for them, through all stages of the process.

What “accurate risk assessment” means to insurers

It’s not just about your risk assumptions.

If you can assess risk accurately and generate greater confidence in your portfolio, while reducing the amount of friction and the average time it takes to process an application & issue a policy; then you will improve your relationships & trust with distribution groups, and elevate your organization’s reputation.

Furthermore, by consistently adjusting your underwriting philosophy and optimizing your risk assessment accuracy over time, organizations can improve their competitiveness and profitability models.

With a near-effortless deployment, underwriters can finally achieve immediate control over every underwriting journey created for applicants. With the power to continually review and optimize the journey, underwriters can reduce the number of cases requiring manual verifications without sacrificing accuracy; and be able to focus on higher-priority items including applications that truly require manual underwriting reviews. Implementing the liz suite means achieving higher efficiency; and they can now get involved in different areas of the business with greater impact thanks to the time saved.

Every product is priced to a certain risk appetite. Implementing liz means if an organization accepts this risk, they can model their application process to that risk appetite, without ever exceeding it. Underwriters would be able to continuously improve their underwriting philosophy to better optimize advisors’ and applicants’ experiences.

An organization’s risk appetite and underwriting philosophies don’t have to be carved in stone for all eternity. Constant adjustments can be made. With our tools, firms can tailor offerings, increase conversions, and more efficiently get people covered. All with less detective work, and that is something we can all celebrate.

Contact us to see how easy it is to get started.