How thinktum’s technology can make insurance more accurate and trustworthy

How can suspicion and a lack of trust affect an entire industry? Easy, if we’re talking about life insurance. It generally starts with one person having a bad experience and talking it up to anyone who will listen. We know that public perception can be hard to change, but we can help.

That lack of trust is nothing new.

The modern insurance organization hasn’t changed all that much from 50 or even 100 years ago. Applicants are still required to disclose all of their health details, good and bad, in order to secure coverage. Advisors still advocate for their clients, especially when the underwriter decides the risk is too high and declines the application. Insurers distrust applicants, who in turn, distrust the industry.

The reason is a systemic lack of trust between advisors and applicants, and in turn, the mistrust people now have toward the industry as a whole because of so many stories about unpaid claims. You see, risk assessment models are designed to protect the financial interests and reputation of insurance organizations. Applications are problematic since opaque questions are prone to incorrect interpretation leading to misunderstandings. In the end, advisors and applicants often provide partial or insufficient disclosures.

How can we ever get past all this?

Accuracy and trust are the cornerstones of any business, certainly including the insurance industry, but there is a long way to go to ensure both are built into new insurance tools and websites.

Insurance can be better for advisors, applicants, and the organization.

Read more about how to optimize user experience in The value of transparency in a customer journey.

How to trust in a historically untrustworthy environment.

Organizations relied on their advisors to bring in business. It wasn’t perfect but they, along with underwriters, became the corporate vetting process for anyone applying for a policy, whether it was reliable or not. That vetting involved in-person meetings or at least phone calls, doctors’ reports, lab results, and other supporting documents. So, yes, there was trust, but also verification.

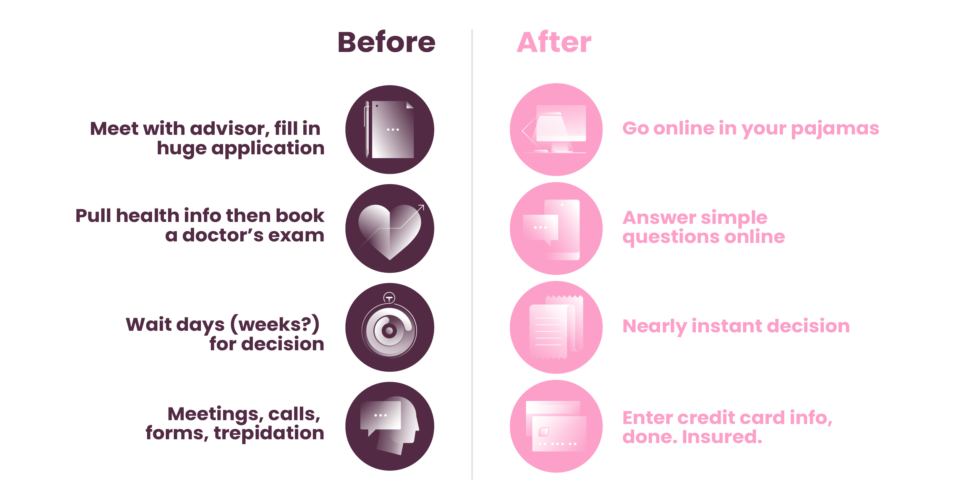

Now, people can apply for life insurance on their phone or other device, whenever they like. In the time it takes to commute to an office from the suburbs, a person could apply for a policy and receive a determination. No medical questions involved! How does vetting happen now? Has insurance become so convenient it’s no longer secure? How do we make sure applicants properly disclose all relevant information to make a smarter, more accurate determination?

For many people, the internet is an anonymous playground, which of course is antithetical to ensuring honest reporting and transparency for an insurance product. People act differently on it than they do in real life. They may feel that truth-stretching may not be identifiable within an application or website. That couldn’t be further from the truth. The level of anonymity has helped and hurt how honest people are online.

But a lack of trust also existed (and still persists in some organizations) between advisors and the business due to agents applying pressure to push policies through the approval process without always fully understanding the risks associated and potential impact, all to get an approval faster.

There is generally accepted suspicion in the industry and occasions where advisors may push hard and look for application loopholes that maximize the chances of approval. They may apply pressure on the business to accept risk that may not be lucrative to the organization. In turn, those policies might result in misrepresentation or fraudulent disclosure, meaning claims will likely be denied at a later date.

So now there’s mistrust on two levels. How do we get past it?

An environment of mistrust in all directions is no way to build fruitful and long-lasting relationships between providers, advisors, and the insured.

But wait, there’s more!

A traditional or static customer journey is commonly utilized within Accelerated and Simplified Issue underwriting models. Conventionally, every customer journey, whether it was manned or unmanned used a series of questions to gather information. The term “static” refers to asking everyone the very same questions, regardless of gender, age, health, habits, and activity levels. With modern technology, questioning can now be dynamic, meaning the questions change depending on the data supplied by applicants.

Consumers are also getting craftier. An applicant can answer “no” to every question and may get the coverage they want, but there’s a chance of accidental misrepresentation or misunderstanding – so again, an instant lack of trust happens. That’s why insurers have so many things verified, because they don’t trust answers to the questions they themselves decided to use. But the current landscape’s regulations and risk appetite don’t foster the necessary courage and creativity to do something about it. Insurers can hardly achieve accuracy because the current process is designed to filter in only the best risk (super healthy), which still requires a majority of applications to go through manual review.

Traditional insurance allowed the underwriters to decide. Now, we’re asking technology to recommend a decision and that’s a huge leap for many.

A primer on risk

Every insurance firm has a few tools in its kit to better understand and manage the risk involved in their business.

- Risk appetite is how much risk an insurer will abide by. Every insurer’s risk appetite is slightly different, depending on a lot of different factors. Some organizations are fine with a higher level of risk than others. Older, larger, more conservative insurance organizations tend to have a more orthodox risk appetite.

- An underwriting philosophy is the actions the insurer takes to achieve that risk level laid out in the risk appetite.

In order for an insurer to be successful, both of these tools must be in place and adhered to.

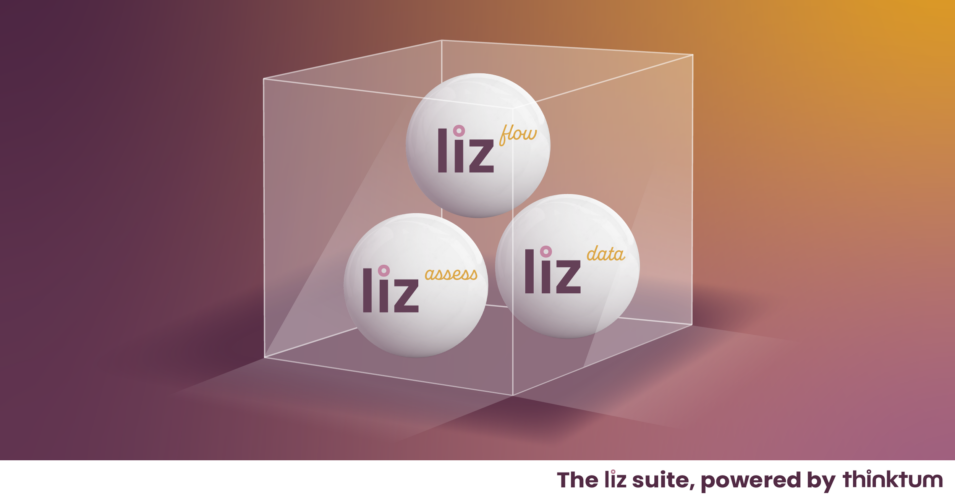

Meet liz, maybe for the first time.

At thinktum, we reinvented the customer journey to better reflect a modernized approach.

Here’s how:

|

It begins with liz flow, our Pure no-code e-app module with customer experience editor. Our technology allows questions to be written, uploaded, and tested whenever it’s required. If a question becomes problematic, it can be edited or entirely removed in seconds. This level of control is nearly unheard of in the industry. |

|

Our next module is liz assess, our hyper-personalized underwriting rules engine. Built to support all underwriting combinations, the technology simply and easily slides onto your existing technology infrastructure. This is the very basis of our revolutionary customer journeys. |

|

Last is liz data. This module delivers AI-driven data analysis with built-in logic as a case management platform. liz data provides real-time alerts and full data analytics for timely actionable insights in a highly intuitive dashboard. |

With the liz suite, no two customer journeys will ever be identical because each is highly customized to the end user. That hyper-personalization means a better experience for applicants, a secure and logical determination, and a better ROI for the business. Each module can act on its own or in conjunction with your existing technology although using all three modules is the most efficient and efficient way to supercharge your customer journey.

The tools liz offers ensure honest disclosure by drilling down to make better assumptions using a dynamic tailor-made underwriting process.

Dig deeper into our software solutions with thinktum’s liz Suite.

Let’s talk precision.

Our liz data module provides much-needed data analysis for the information collected from each customer journey. The system collects both user data (the information applicants provide during the journey) as well as behavioral data (the information the system collects regarding the applicant’s behavior).

The system’s data analysis functionality monitors an applicant’s behavior throughout the journey. The system tracks every answer change, it follows how long it takes for answers to be completed, and if and where the person abandons the application altogether. Data such as this can add a valuable layer of precision onto every journey. Changes like that can be indicative of someone trying to obfuscate the truth, or even, of very badly worded questions. These behavioral analytics provide the business with crucial and easy to use insight.

With a hyper-personalized customer journey, accuracy comes with the data collected. thinktum ensures we understand everything we can about the applicant during the customer journey. There is no point in scrutinizing a person’s information AFTER you provide them with a policy.

We provide the verification insurers are looking for, including:

- Behavioral analytics that pinpoints negative or concerning actions

- Precise questions to elicit more precise answers, and mostly, much less inaccurate ones

- Better phrasing with proper follow-up questions, providing a more accurate snapshot of health issues

- A faster, more frictionless customer journey attractive to younger applicants

Hyper-personalization to the rescue!

With thinktum’s modular Pure no-code suite, you can completely overhaul your customer journey process in a matter of a handful of days, rather than months. Our editable canvas allows you to see every interaction as it happens, and delivers the ability to edit and test questions on the fly. Having control like that means the business can use the hyper-personalized underwriting rules engine module to pull the right information at the right time.

Read up on how tailor-made benefits you with Hyper-personalization paves the road to success.

Meanwhile, our data analysis module gives the business insights into how the application was completed, and which questions proved to be the most problematic. The intuitive dashboard delivers the kind of data you’ve been asking for, including tracking question changes, additional time spent on specific parts of the application, or where drop-offs happen, which are symptoms of either the wrong question being asked or an applicant’s nervousness about answering. Either way, the system catches problems and displays them so the business can change the question or decline the application, giving the business the most control it’s had in ages and perhaps ever.

Applicants will enjoy the following:

- Faster and easier applications help people get the insurance they need

- Having the right questions asked in the right way reduces confusion and inaccuracies

- Receiving a determination in minutes is what people are after

- Being actually protected by a policy they keep paying for each month will, in time, reverse the negative perception people have of insurance.

Organizations will experience these benefits:

- Hyper-personalization increases conversions

- Accuracy and speed will also be improved

- Ease of use and proper data leverage for optimal process efficiency

- The ability to identify problematic questions with instant editing capabilities, all without requiring any IT resources’ involvement

- Fostering a positive relationship and providing tips to stay healthier provides appreciable value

The life insurance business has been around for a long time and will continue to be for years to come. Technological advances mean that applications are easier for people to get through and end in more policies being written. That’s better for the new policyholders in that they have the financial protection they want and feel they need. Businesses are confident knowing the data collected is correct, and seem to be writing more & better policies than ever. Moreover, they are meeting their KPIs for perhaps the first time ever.

Learn more about revolutionizing your business cycles from end to end, book a meeting with us today!