Supercharging Distribution Groups with thinktum

Distributors have unique challenges in the insurance industry. Between their outdated technology, not having enough staff on hand, and a focus on converting leads into sales, their rickety infrastructure can hamper any success the organization may have. But what if a robust and intuitive solution was available today? It is. Meet liz.

The issue

For Insurance Distributors, their most common problems stem from underutilized resources. Between ensuring they have enough qualified staff and adequate resources to convert leads into sales, lead generation is only as successful as the systems in place allow. That’s because each lead has to be vetted to ensure it is genuine, secure, and appropriate; and when a system generates thousands of leads a day, how can an antiquated platform keep up? How do staff ensure leads are followed up in a timely way to ensure a high conversion rate? Advisors do their best trying to maintain their low attrition rate, while some applicants fall through technology or resource gaps.

Even worse, some unethical distributors may resort to unethical selling practices to boost their conversion numbers when they start to fall precipitously.

This isn’t sustainable. But what’s the solution and how can thinktum help?

Solutions

There is a solution that alleviates most of the issues Distributors face. thinktum’s Pure no-code software suite, liz and specifically our liz assess module revolutionizes the online assessment process. Here’s how.

liz assess takes every lead and:

- Prequalifies it

- Segments it

- Assigns it

- Prioritizes it

It’s not just that these tasks are completed without human intervention, but liz provides a more robust selling environment for both the advisor and the applicant, gives advisors greater confidence in the quality of leads, increases communication between both parties, and adds a layer of highly valued personalization not typically found in the process.

When liz data is included in the mix, constant monitoring and an optimized flow between each module is achieved, improving the process for everyone involved. Advisors are more productive, clients are now insured, and a healthier bottom line is achieved, ethically.

For a use case involving different actors of the industry, read How insurance carriers are modernizing their technology to meet KPI goals.

Benefits and advantages

With thinktum’s liz suite, Distributors can accomplish the following results:

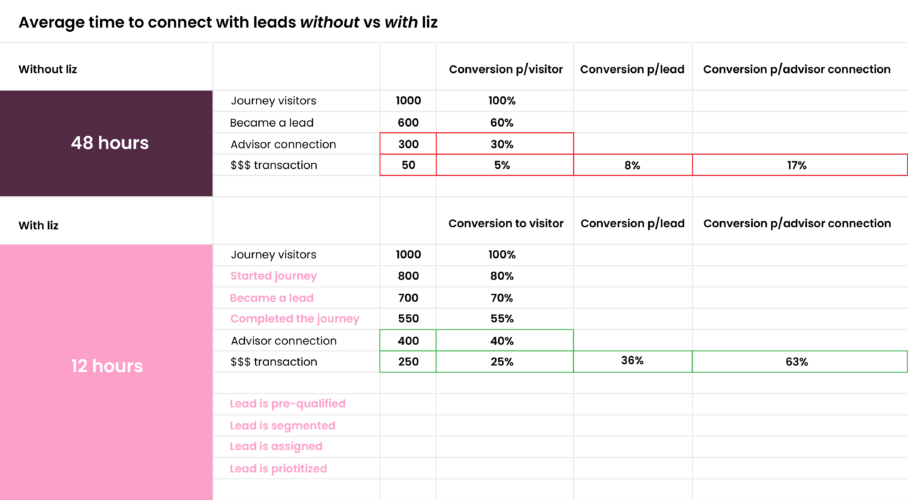

- Connecting leads to advisors occurs faster

- Conversion rate per visitor increases significantly

- Conversion per lead goes up by a lot

- Their advisor connection per conversion is multiplied

See the difference liz makes in the table below.

liz can completely and automatically transform your conversion issues into sales. It’s faster, more secure, and incredibly accurate.

Contact us today to learn more!