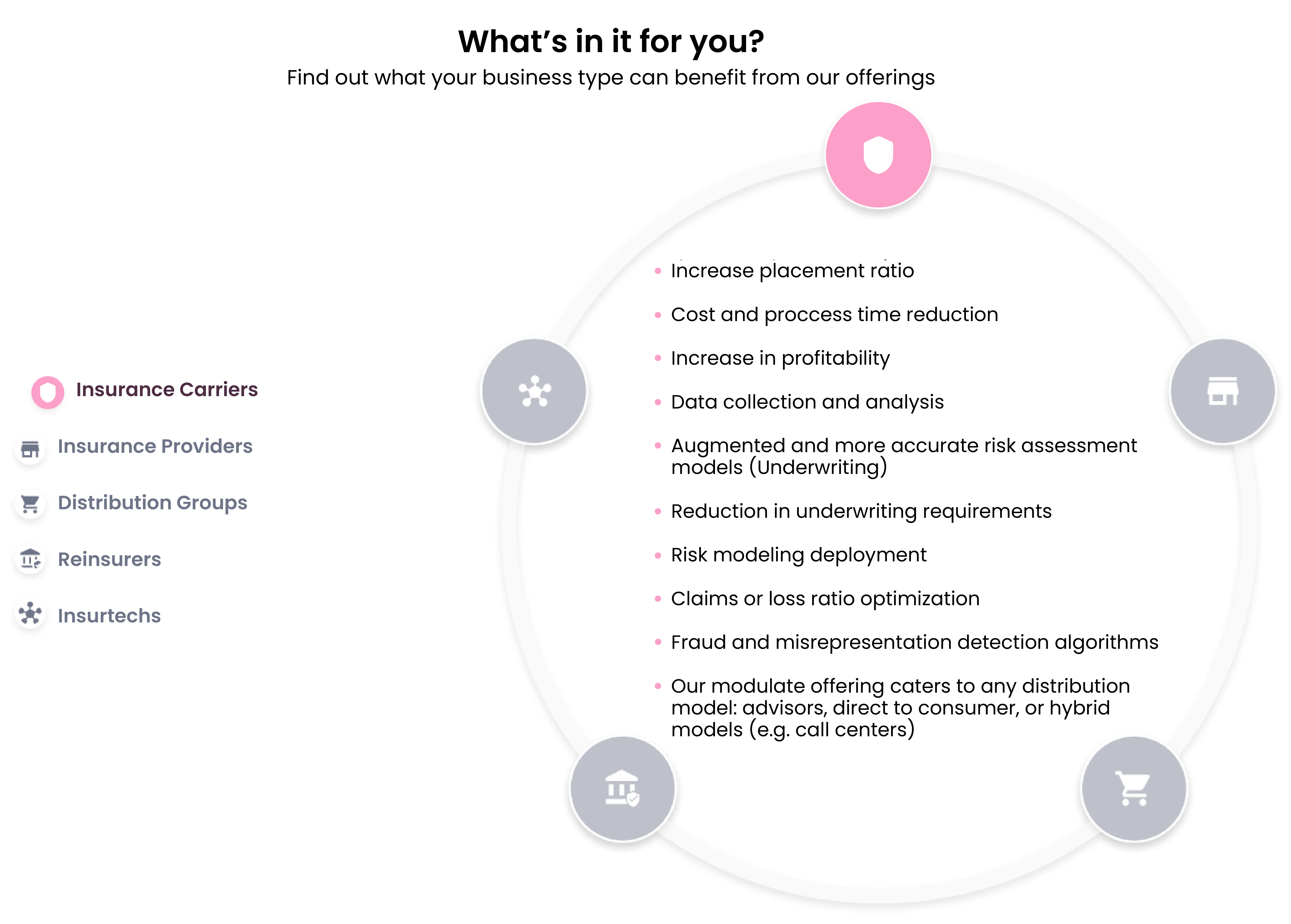

How Insurance Carriers are Modernizing their Technology to Meet KPI Goals

Typically, insurance carriers are the big business brands we’re all aware of. Too many of these heavy hitters have yet to decide they need to up their technology game, though. As they hold back, their competition is already way ahead of them, plunging into new and innovative tech solutions. The best news is with thinktum, they can catch up and overtake those other firms in no time at all. It just requires a leap of faith and the liz suite.

Insurance Carriers seem to be in a state of flux, and moving ever slowly toward adding 21st century technology to a 19th century industry. People are looking to purchase insurance products the same way they purchase so many other items – online. Accepting that premise means the industry has to revamp how they do business and where; but it isn’t as simple as adding an application form to a website. That’s why so many Carriers are looking to firms like thinktum, in order to modernize their technology infrastructure to accommodate this new environment.

Here’s just one example of how insurtech enabler thinktum changes the way a Carrier does business and the astonishing results that can be achieved.

The issue

A mid-size North American Insurance Carrier had a problem. They had to modernize their outdated technology and complex application processes to allow for a more automated and streamlined platform, in order to remain competitive and viable. After auditing their systems, they realized there were three distinct issues to solve:

- The organization struggled to achieve their goal of completed applications without human intervention

- Around 60 percent of the existing electronic application process still required intervention from an underwriter

- Their current outdated process was causing delays, negatively impacting the customer experience and the company’s reputation among their advisors

In order to stay relevant, they needed to transform their business. Something needed to change. But what?

Solutions

The CTO and his team were intrigued by emerging technologies, including the rise of no-code, artificial intelligence, and machine learning in their industry. But which solution was right for them?

The team reached out to thinktum, an insurtech enabler, with the following list of questions:

- How can we improve our Underwriting Program process to ensure over 70 percent of new application business be instantly achievable without human intervention? And then with time, to improve the system to over 90 percent?

- How can our company maintain or improve accuracy, as well as increase honest disclosure and avoid fraud and misrepresentation with an automated process?

- How can we monitor and update the process easily?

And thinktum’s team provided these recommendations:

- thinktum’s hyper-personalized underwriting rules engine module, liz assess, supports any and all combinations of underwriting models. Underwriting flows can be adjusted easily to the desired risk appetite and can optimize automation to over 90%. Human intervention is typically only required for some unusual cases and quality assurance purposes. liz assess differs from other automated underwriting platforms by applying hyper-personalization algorithms. It assesses risk in a detailed and unpredictable manner, maximizing the proposed insured honest disclosure. By doing so, the system can more quickly identify and mitigate risk and fraudulent activity than a human can. thinktum’s modular solution is also so highly personalized that it minimizes misrepresentation and fraud.

- thinktum’s Pure no-code technology is designed to be easily deployed, maintained, and upgraded with minimal IT resources. After its implementation, it allows business experts (e.g., actuaries, underwriters, business analysts, etc.) to easily create, monitor, adjust, and update the process instantly and as frequently as required, without the need for IT resources.

- Finally, thinktum’s modular technology suite, liz, has been designed to provide real autonomy and transparency for business experts within insurance companies. liz assess powers a hyper-personalized customer journey and experience, collecting more detailed and relevant data to achieve a greater risk assessment precision, minimizing human intervention, and making the entire process faster.

Explore an alternative use case with Supercharging distribution groups with thinktum.

Benefits and advantages

With an initial liz data integration, the Carrier achieved the following results:

- Get more business processed straight-through

- Fewer electronic applications require human intervention

- Modeling and deployment can be achieved in days

Book a meeting with us to learn more about achieving these kinds of results for your company!